Managing student loans can feel overwhelming. Between juggling multiple loans, varying interest rates, different payment schedules, and due dates, it’s easy to lose track and feel stressed. That’s why using reliable student loan payment tracking methods is so important. Tracking your payments helps you avoid late fees, ensures you’re on top of your finances, and gives you a clear picture of your progress toward paying off your debt. With the right approach, you can plan strategically, make extra payments when possible, and even pay off your loans faster.

Here’s a detailed guide to some practical and user-friendly ways to track your student loan payments.

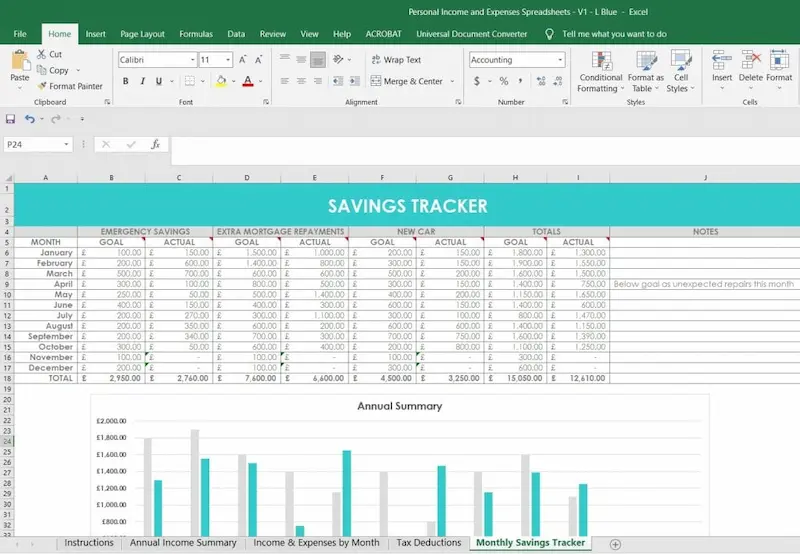

1. Use a Spreadsheet for Simple Tracking

Spreadsheets might sound old-school, but they remain one of the most effective ways to monitor your student loans. Programs like Microsoft Excel, Google Sheets, or Apple Numbers allow you to organize your loans in a way that works best for you.

How to set it up:

- List each loan separately: Include details such as lender, loan type (federal or private), interest rate, balance, and minimum monthly payment.

- Track payments: Create columns for payment dates, amounts paid, and the remaining balance after each payment.

- Visualize progress: You can use charts or graphs to see how your loan balance decreases over time.

Why it works:

- Full control and flexibility over your data

- Ability to see multiple loans at a glance

- Helps in planning extra payments or prioritizing high-interest loans

A spreadsheet is perfect if you enjoy a hands-on approach and want a clear, visual record of your repayment journey.

2. Use Loan Servicer Websites and Apps

Most student loan servicers provide online accounts that make tracking your payments easier than ever. Some popular servicers include Nelnet, Navient, MyFedLoan, and Great Lakes.

Benefits of using servicer websites/apps:

- View upcoming payment due dates

- Check your remaining balance and accrued interest

- Set up automatic payments directly

- Access tax documents for your loans

- Receive notifications about your payment status

Many servicer apps let you track multiple loans in one place, which is especially useful if you have a mix of federal and private loans. You’ll also get real-time updates on any changes to your loan, such as interest capitalization or deferment options.

3. Set Up Automatic Payments

One of the easiest ways to avoid missed payments is to set up automatic payments (auto-pay). Not only does it help ensure you pay on time, but most lenders also reward auto-pay participants with a small interest rate reduction (usually 0.25%).

How to set up auto-pay effectively:

- Choose a payment date that aligns with your pay schedule

- Ensure the system pays at least the minimum due, though paying more can accelerate repayment

- Monitor your account occasionally to confirm payments are processed correctly

Auto-pay combined with another tracking method, like a spreadsheet or app, gives you peace of mind while keeping you fully in control of your repayment plan.

4. Use Personal Finance Apps

If you like managing all aspects of your finances in one place, personal finance apps are a great solution. Apps like Mint, YNAB (You Need a Budget), PocketGuard, or Personal Capital can help you track student loans along with your other financial accounts.

What these apps offer:

- Consolidate all your loans and bank accounts in one place

- Track spending and create budgets that factor in student loan payments

- Set reminders and notifications for upcoming payments

- Analyze your financial trends and progress toward debt freedom

Using a personal finance app is excellent if you want a more holistic approach to money management while keeping your student loans front and center.

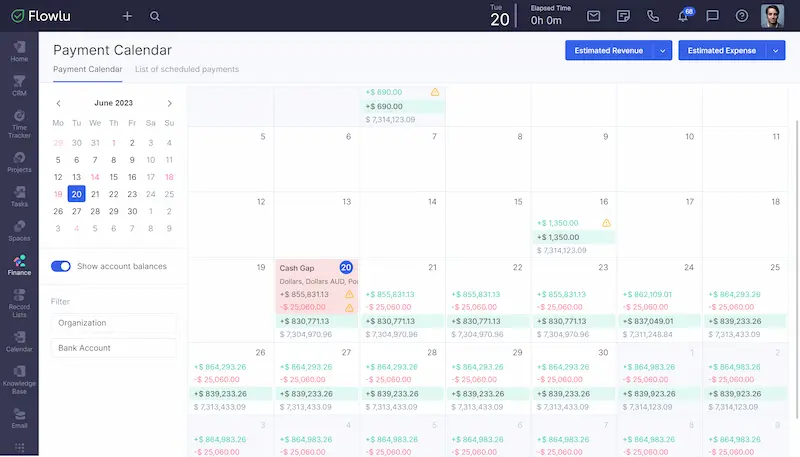

5. Create a Payment Calendar

If you’re a visual person, a calendar is a simple but powerful tool. You can use a digital calendar (like Google Calendar or Outlook) or a physical planner to track due dates and payments.

Tips for a payment calendar:

- Mark each loan’s due date clearly

- Highlight extra payments or partial payments

- Set recurring reminders a few days before each due date to ensure timely payment

Calendars help prevent late payments, keep you organized, and provide a quick, at-a-glance overview of your repayment schedule.

6. Track Extra Payments and Principal Reductions

One of the most effective ways to save on interest is to make extra payments toward the principal. But tracking these payments is crucial to make sure they are applied correctly.

How to track extra payments:

- Note when extra payments are made

- Specify whether it’s applied to principal or interest

- Update your spreadsheet, app, or calendar accordingly

Tracking extra payments allows you to see how much faster you’re reducing your debt and motivates you to continue making progress. Over time, these small additional payments can save thousands in interest and shorten your repayment period significantly.

7. Prioritize Loans Strategically

Not all student loans are created equal. Some have higher interest rates, while others may have benefits like income-driven repayment options or forgiveness programs. Tracking methods can help you identify which loans to pay off first.

Strategies to consider:

- Avalanche method: Focus on paying off loans with the highest interest rates first while making minimum payments on the rest. This saves money over time.

- Snowball method: Pay off the smallest loans first to gain momentum and motivation, then tackle larger balances.

By combining these strategies with a tracking system, you’ll have a clear roadmap for reducing debt efficiently.

You may also like to read this:

Best Ways To Manage Student Loans And Repay Faster In 2025

The Ultimate Guide on How To Organize Student Loan Payments

14 Simple Student Loan Management Tips To Save Money

How To Pay Off Loans Faster: Easy Steps To Become Debt-Free

Manage Multiple Student Loans Easily: Complete Guide

8. Keep a Record of Loan Documents

Tracking payments isn’t only about dates and amounts; keeping your loan documents organized is equally important. Maintain digital or physical copies of:

- Loan agreements

- Payment receipts

- Statements and tax forms

Organized records help in case of disputes, overpayments, or if you apply for forgiveness programs. It also makes updating your tracking system easier and more accurate.

9. Monitor Interest Accrual and Capitalization

Interest accrues daily on most student loans, meaning your balance can grow if unpaid. Some loans capitalize interest, which means unpaid interest is added to the principal balance, increasing future interest.

How tracking helps:

- You can see how interest accrues over time

- Identify opportunities to make extra payments toward interest or principal

- Prevent surprises in your balance due to capitalization

Using a spreadsheet or app that calculates projected interest can give you a clear picture of how much you can save by paying extra.

10. Reassess Your Tracking System Periodically

Your financial situation may change over time. Perhaps your income increases, you consolidate loans, or switch repayment plans. Your tracking method should evolve with these changes.

Tips for reassessing:

- Review your tracking system every 3–6 months

- Adjust for new loans, interest rate changes, or repayment strategies

- Look for trends and identify areas where you can accelerate repayment

Regular reviews ensure your tracking method remains effective and aligned with your goals.

11. Consider Loan Consolidation or Refinancing

Tracking your loans effectively can also help you identify opportunities to consolidate or refinance. These strategies can simplify repayment by combining multiple loans into a single payment or lowering interest rates.

Tracking benefits:

- Compare current loan balances and interest rates

- Calculate potential savings with refinancing or consolidation

- Monitor progress after making changes

Having a detailed tracking system ensures you make informed decisions when considering refinancing or consolidation.

FAQs: Student Loan Payment Tracking Methods

Q1: Why is tracking my student loans important?

Tracking ensures you never miss payments, helps you monitor progress, and encourages smarter financial decisions to pay off your loans faster.

Q2: Can I track multiple loans in one place?

Yes! Many loan servicer apps and personal finance apps allow you to track multiple loans simultaneously, making debt management much easier.

Q3: Is it better to use a spreadsheet or an app?

It depends on your preference. Spreadsheets are highly customizable and free, while apps offer automation, notifications, and integrate with your other financial accounts.

Q4: How often should I update my tracking system?

At least once a month, after making payments, to ensure your records are accurate and up-to-date.

Q5: Can tracking my loans save me money?

Yes. By monitoring payments, prioritizing high-interest loans, and applying extra payments to the principal, you can reduce interest costs and potentially pay off loans faster.

Final Thoughts

Keeping track of your student loans doesn’t have to be complicated. By using student loan payment tracking methods—whether it’s spreadsheets, servicer apps, auto-pay, personal finance apps, or a simple calendar—you can take control of your repayment journey, avoid late fees, and save money on interest.

The most important factor is consistency. Pick a tracking method that fits your lifestyle, use it regularly, and watch as your loans gradually decrease.

With the right tracking tools and a bit of discipline, paying off student loans can feel far less stressful—and even manageable.